2024: A Year of Storms, Losses, and Legal Challenges in the Insurance Sector

In 2024, the insurance industry faced immense challenges due to numerous storms and natural calamities, resulting in economic losses exceeding $258 billion. Significant hurricanes, particularly Milton, caused extensive property damages and raised public concern over corporate accountability, highlighted by high-profile lawsuits affecting major brands. Claims Journal drew attention to these pressing issues as they directly influenced the insurance landscape.

The year 2024 witnessed significant natural disasters, primarily from Atlantic storms that severely impacted the insurance sector. This hurricane season not only brought numerous named storms but also global natural catastrophes, elevating losses substantially. Claims Journal has noted a steep increase in both economic and insured losses, with estimated figures exceeding $258 billion and $102 billion, respectively, as reported by Aon plc. High-stakes lawsuits also gained traction among readers, including notable cases involving major corporations such as McDonald’s and Sony Pictures.

The third quarter of 2024 was particularly harrowing, marked by economic losses significantly exceeding those in 2023. An estimated 280 notable global disaster events contributed to this scenario, likely propelling total annual insured losses beyond last year’s $125 billion. Particularly, Hurricane Milton brought extensive flooding across Florida, resulting in over 221,582 claims and an insured loss exceeding $2.7 billion, which may further escalate depending on the ongoing assessments by various firms in the insurance industry.

In response to the heightened number of insurance claims following Hurricanes Helene and Milton, officials in Tennessee and Florida have taken proactive measures. The Tennessee Department of Commerce and Insurance has mandated insurers to report claims data related to Hurricane Helene. Meanwhile, Florida’s Hurricane Catastrophe Fund is expected to cover approximately $4.6 billion for the losses incurred, indicating the challenges insurers face, though no immediate premium surges are anticipated.

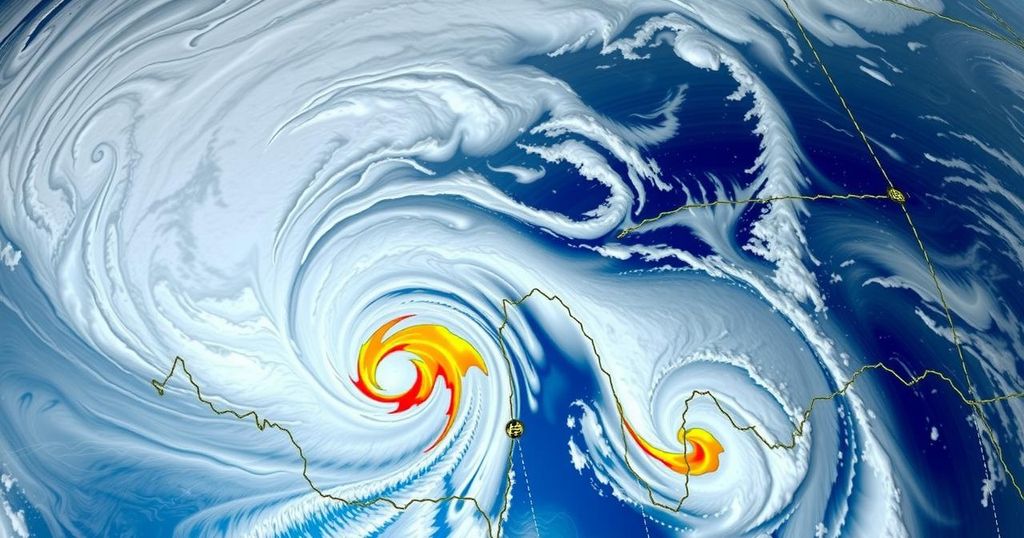

Globally, storms continued to wreak havoc, particularly in Spain, where severe floods resulted in extensive damages and are projected to surpass €3.5 billion in insurance losses. In Taiwan, trading was halted amid the approaching Typhoon Kong-rey, which has been deemed one of the most powerful storms in three decades, leading to significant crop losses and further complicating the economic landscape.

The year was also marked by high-profile lawsuits capturing the public’s attention. A class action suit against Meta Platforms Inc. in the U.K. highlighted concerns over user data exploitation. Abbott Laboratories faced a legal victory concerning claims about its infant formula, while lawsuits against McDonald’s regarding an E.coli outbreak linked to its products garnered significant public interest. Such issues collectively reflect the intertwined nature of natural disasters and corporate accountability within the insurance domain.

The insurance industry in 2024 faced unprecedented challenges due to multiple severe weather events, particularly storms originating from the Atlantic. This year experienced an uptick in economic and insured losses, marked by significant catastrophes T across various global locations. The ongoing analysis by institutions like Aon plc illustrates the magnitude of losses attributed to these disasters, while also emphasizing the reaction of insurers and the overarching legal landscape surrounding high-profile corporations amidst crises. Understanding these elements provides insights into the industry’s current state and future outlook.

The year 2024 has been characterized by significant natural disasters that have imposed substantial financial strains on the insurance industry. The devastating effects of hurricanes and other severe weather events led to a considerable number of claims and highlighted lapses in corporate responsibility as seen in various lawsuits. The collaborative response from regulatory bodies and the insurance sector underscores the necessity for improved frameworks to address the repercussions of such catastrophic occurrences and the implications for all stakeholders involved.

Original Source: www.claimsjournal.com

Post Comment